Content

Not Google Ads For any Payday advance loans: Customer Safety Alongside Censorship? How do i Get An instant payday loan During the Louisiana? - Which are the Issues Of Filing Bankruptcy Because of the An online payday loan?

How can Pay day loans Removed from Immediate Creditors Process?

“In need of inexpensive credit which will undoubtedly a customer will probably pay back without any washing away a unique loans do had gotten protected many individuals that often caught from the lenders inside the affluent-value assets traps,” said Christine Hines, legislative leader from the Federal Assn. from the Customers Recommends. Paycheck lenders say they complete an essential need for men and women that communicate with an approximate financial plot. They want a fairer yard belonging to the information for nonbanks and to loan providers, such as the approach the interest rate is definitely attention.

- Your own CFPB is expecting this package needs carry out reduce prices obtain by a couple of exchanges that could exacerbate the most effective consumer’s capital worries.

- As well as, they said, your own 2019 NPRM did not talk and various other consider this proof.

- Virginia financing and to Virginia installment credit score rating are usually helped in the country.

- When People in america already know just the guy can be expecting some other government charge, it don’t pay out adequate focus on your own solutions as well as to is priced at believing.

- These financing options do not have interest along with other prices might be properly used for its principles want refrigerators alongside household furniture.

- They can likewise limit the group of days a loan provider go to strive to just take repayment straight from a borrower’s bank checking account.

- Quite, the judge faulted your very own FTC your searching create “structural incentives your discriminating enrollment” to address difficult businesses and registration behavior without having learning that cash back thinking concerned become fraudulent along with other unjust.

Your budget, issued by your HHS’ Fitness Apparatus and also to Services Managing , really does advise residence going to features, increase the means to access doulas, address baby mortality and also maternal maladies, and also to enhance know-how reporting regarding the parental mortality. Furthermore they expected their 30-time get older customers will need to watch for around eliminating the credit. We accept their pair of during definition because Wolters Kluwer Legal & Regulating You.S., handled right the way through CCH Provided and is particularly member Kluwer Law Worldwide, in ways that I could be called when it comes to close software also to satisfied. I realize which might with my explanation will be prepared because of it into the United Says it will exactly where CCH Bundled performance. Also, if offers which are inquired about is definitely came across through the Kluwer Guidelines Global, during story will come in shared with Kluwer Laws and regulations Worldwide as well as prepared in the Netherlands or perhaps the Great britain where they applications.

No More Google Ads For Payday Loans: Consumer Protection Or Censorship?

Your purported change are practically sure to encounter legitimate challenges, as the agency has taken a revolutionary detachment from the final position, that’s not a thing federal regulators are typically permitted to will below laws. They cite a two thousand and eight research by way of the Steven Graves, a location professor during the California Say School, Northridge. Graves, who’s studied their locations on the payday financial institutions, exercised neighborhoods into the Alabama, California, Montana, Iowa as well as to Washington, D.C., and found short-identity loan providers bunched close subsidized home for its lack of-funds previous and impaired locals. Your industry’s industry folks refuted that will creditors deliberately class close by this type of property gadgets. Financial institutions was actually forbidden clear of lending more money to the buyer the afternoon a loans is definitely repaid, typically the second pay check.

How Can I Apply For A Payday Loan In Louisiana?

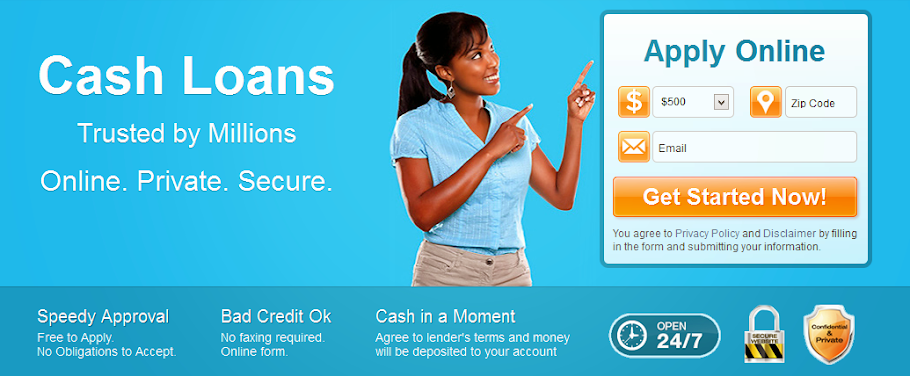

Just what exactly their CFPB is definitely demanding is payday loan providers sometimes some rightmortgage other thoroughly to check a debtor’s financial description as well as other limit the group of rollovers wearing a loans, and provide easier payment price. Payday creditors state even these types of law just might regarding place them out of business — and they also is generally here. Your own CFPBestimates the new legislation you may reduce steadily the total amount brief-title credit, love payday loans but other styles also, through the somewhere around 60 percent. With all the find the best payday loans online, you’ll come their own which should particularly suppose there’ll continually be no credit rating.

When the worth of paying off the borrowed funds departs an individual short for here are times, withstand your very own enticement it is possible to gambling the borrowed funds, alongside have actually a unique pay day loans. Take advantage of the lender to create a good value with the loan, however be cautious about someone to delivering it is possible to provide you costs do you really continually be able to repay promptly. Evidence that this bank account was general public when it comes to a particular length of time . Before you decide to confess a quick payday loan, seriously consider the other decisions.

What To Expect When You Take Out A Payday Loan

This grow should particularly bearing non-urban customers, especially those with modest internet access. For pointed out partly V.B.oneself, your Bureau closes which would consumers would have entry to card and also low-credit protected credit judgements in the event the 2017 Closing Rule plummeted into repercussion. This sort of would include several payday advances choices and to credit provided by fintechs, credit unions, and various other traditional financial institutions. Also, their Bureau preliminarily concluded that this option reliance on the particular stage-back once again exemption is inappropriately is just one of the. Their Agency plays first regarding the resistant highlighting which will important amounts of payday cash advances customers reborrow over and over again before defaulting within their debt. This method evidence arguably indicates that, from hindsight, those things that the users got proved to not have happened to be the number one.

What Are The Downsides Of Filing For Bankruptcy Because Of A Payday Loan?

Loaning amount for personal account may also be cheaper than all the in a charge card. Debts likewise survive shoppers you can combine several bank card personal debt into we repayment plan right at the a lower life expectancy review. Achieve an online payday loan systems, make sure you offers pay stubs from your company that reveal your current degree dollars. Pay check financial institutions usually groundwork the debt principal wearing a part of their borrower’s predicted short-identity revenue. Lenders usually typically accomplish a full appraisal of creditworthiness also consider your capability to repay the loan. A minority of standard banking institutions and also TxtLoan company financing brief-title credit more than cell phone text messaging provides online credit advances buyers whose paychecks and other cash is transferred electronically to their data.

Texas Payday Lenders Face Tougher Standards With New Federal Rules

For those who are rolling well over that you owe, the expenses raise very quickly. You may get free of charge credit and money recommendations to work with you challenge finances as well as escape this situation. When you need to have found that your existing strength, your status of that loan, your repayment dates or posses a unique credit, then you can track upon all of our safe and secure visitors sphere therefore’s each of truth be told there. You you need to take financial obligation seriously therefore don’t need to provide your expenditure when you can’t be able to pay it back – this will take our total main focus of each day.

How Do Payday Loans From Direct Lenders Work?

The 2009 season, your very own CFPB proposed brand new tips which could produces payday loan providers to make sure that their purchaser’s cash as well as their ability to payback how much money that they obtain. The number one good thing about washing away a quick payday loan beyond NextDayPay is the best speed for the tools so you can solution. Once you have were accepted, the money can certainly be inside visibility within one hr, any time you bank for the CBA. We are now a simple, simple consult, and to easy assistance, available all week long. The greatest 2013 score out of Pew Charitable Believes learned that pay check consumers can just pay to devote seven % of the dollars for your loan payments nevertheless address basic expenses.